Aramis Shop: Your Hub for Stylish Living

Discover the latest trends in home decor, fashion, and lifestyle at Aramis Shop.

Trade Bots: Your New Best Friends in CS2

Discover how trade bots can revolutionize your CS2 gameplay. Unlock profits and level up your strategy with these game-changing allies!

How Trade Bots Are Revolutionizing the Trading Experience in CS2

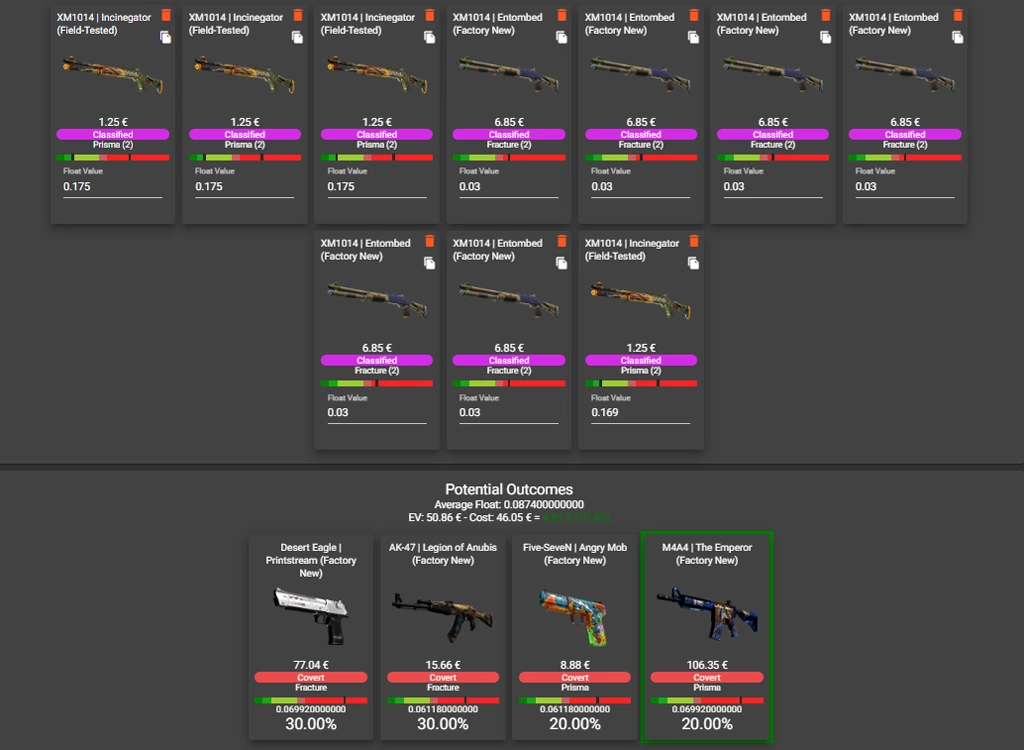

In the ever-evolving realm of CS2, the emergence of trade bots is revolutionizing the trading experience for gamers and collectors alike. These sophisticated algorithms are designed to automate the trading process, allowing players to quickly and efficiently acquire desired items while reducing the manual effort typically required. By leveraging real-time market data and employing advanced strategies, trade bots can execute trades at lightning speed, ensuring users never miss out on lucrative opportunities. This automation not only saves time but also enhances the overall user experience by making trading more accessible to both novice and seasoned players.

Moreover, trade bots are equipped with features that analyze market trends and predict price fluctuations, providing users with valuable insights into the best times to trade. By utilizing these tools, players can optimize their trading strategies, leading to increased profitability and a more strategic approach to managing their in-game assets. As the demand for trading bots continues to grow within the CS2 community, it is clear that they are reshaping the landscape of digital trading, making it more efficient, intelligent, and user-friendly than ever before.

Counter-Strike is a widely popular first-person shooter that has captivated millions of gamers worldwide. Players engage in team-based combat, completing objectives such as bomb defusal or hostage rescue. The game has not only fostered a competitive gaming scene but has also led to a thriving economy centered around expensive skins that players can buy, sell, or trade.

Top 5 Benefits of Using Trade Bots in CS2: Efficiency and Strategy

In the rapidly evolving landscape of competitive gaming, trade bots in CS2 have emerged as a game-changer for players seeking to enhance their in-game economy management. One of the top benefits of using these automated tools is their efficiency. Trade bots operate round the clock, allowing players to manage their trades and inventories without the need to be online constantly. This means you can focus on improving your gameplay skills while the bot systematically handles your trades, ensuring you never miss out on valuable opportunities to acquire essential gear or skins.

Moreover, leveraging trade bots in CS2 enhances your strategic approach to trading. With their ability to analyze market trends and pricing fluctuations in real-time, these bots can make informed decisions that a human trader might overlook. By using trade bots, players can automate their strategies based on market conditions, maximizing their profits while minimizing risks. Ultimately, embracing these automated trading solutions provides a significant competitive edge, transforming the way players interact with the in-game economy.

Are Trade Bots the Future of Trading in CS2?

As the digital trading landscape continues to evolve, trade bots are rapidly emerging as pivotal tools for investors and gamers alike, particularly in competitive environments like Counter-Strike 2 (CS2). These automated platforms can analyze vast amounts of data and execute trades at lightning speed, allowing users to capitalize on market fluctuations that human traders might miss. With the integration of advanced algorithms and machine learning techniques, trade bots can adapt to the dynamic nature of trading in CS2, providing users with a significant edge in both performance and profitability.

Moreover, the accessibility of trade bots is democratizing trading for a broader audience. Players, whether seasoned veterans or newcomers, can leverage these tools without needing extensive market knowledge. This shift not only enhances the trading experience in CS2 but also raises questions about the ethical implications of automated trading. As we move towards a more tech-driven future, understanding the potential and limitations of trade bots becomes crucial for anyone involved in trading within CS2. Are these bots truly the future of trading, or will they merely complement traditional methods? The answer may shape the evolution of trading strategies in the CS2 realm.